- Is Riot Blockchain Still a Good Investment Half a Year After Pivot?

- Riot Blockchain's Portfolio

- Recent Controversy and Earnings Report

- Trading History

- Final Verdict

Is Riot Blockchain Still a Good Investment Half a Year After Pivot?

Riot Blockchain (RIOT), formerly a biotech company that produced medical devices, shifted its business model to focus on cryptocurrency last October. The first publicly listed blockchain company in America, Riot Blockchain has concentrated on acquiring and developing companies that specialize in the emerging blockchain sector. It has been over eight months since the company has pivoted its overall strategy. Let’s dive into RIOT’s latest actions and see if it’s still a good investment opportunity.

Riot Blockchain’s Portfolio

Led by new CEO John O’Rourke, RIOT has promptly acquired a diverse portfolio of cryptocurrency and blockchain companies since pivoting away from the biotech sector. Diversifying itself in the blockchain industry, RIOT’s biggest investments have been in a cryptocurrency exchange, a blockchain auditing service, and a telecom smart contract service. Additionally, RIOT has made a massive investment in Bitcoin mining hardware.

Coinsquare

RIOT’s first cryptocurrency investment was becoming the partial owner of Coinsquare, a leading Canadian cryptocurrency exchange. This investment has already proved to be wise as Coinsquare’s valuation is over 15 times the initial valuation from when Riot initially invested. RIOT recently participated in Coinsquare’s latest funding rounding to raise its total ownership to 15% of Coinsquare’s total equity. RIOT’s stake is currently valued at $50mln.

O’Rourke recently commented on the significance of the acquisition, “Coinsquare continues its rapid growth and execution while positioning itself as the leading digital currency exchange in Canada… We believe that Coinsquare offers the most compelling platform to transact in digital currencies in Canada.”

TessPay

In October 2017, Riot Blockchain purchased a 52% stake in TessPay for $320,000 and 75,000 shares of RIOT. TessPay is a blockchain company that offers solutions for telecom companies. Specifically, TessPay’s business model revolves around creating a guaranteed payment system using a blockchain-based escrow service for corporate telecom carriers.

Two months following Riot’s investment, Tess signed a letter of intent to merge with Canada’s Cresval Capital (CVLCF). As part of the merger, RIOT receives 41.6 million shares of Cresval Capital. With the merger expected in the following months, RIOT’s stake in Cresval Capital will be worth more than $2mln.

Verady

In November 2017, RIOT Blockchain invested in Verady, a service company that provides accounting, audit, and verification services for blockchain-based assets. Verady was founded to address the asset reporting gap between traditional accounting companies and the booming blockchain and cryptocurrency landscape.

According to its roadmap, Verady is currently expanding its network of trusted accounting firms on its accounting platform VeraNet and is also developing its Ethereum auditing services. At this moment, little public information is available about the exact status of Verady’s VeraNet tax platform or the current list of customers.

Bitcoin Mining Operation

Riot Blockchain’s biggest investment has been in Bitcoin mining, the focal point for Riot’s cryptocurrency portfolio plan moving forward.

For the month of April, RIOT’s mining operation produced a total of 100 Bitcoin (BTC) and 61 Bitcoin Cash (BCH). Although RIOT mines Bitcoin Cash in addition to Bitcoin, it regularly converts all mined Bitcoin Cash into Bitcoin.

Riot’s mining expansion plans reached 7,850 Bitmain S9 miners that were operational by the end of May that utilized 11.5MW of energy capacity.

Recent Controversy and Earnings Report

Although RIOT hasn’t necessarily been accused of doing anything illegal, Riot Blockchain has been at the center of mainstream media scrutiny and criticism over the past several months.

CNBC Report

In February, CNBC profiled Riot Blockchain in a malicious report that negatively portrayed the newly focused blockchain company. The CNBC report claimed that that RIOT was taking advantage of its blockchain name to pump up its stock price while in fact, the company had no underlying plan to invest in blockchain technology. O’Rourke defended his company, claiming the piece to be completely one-sided.

Although RIOT solidified itself as an actual blockchain company by becoming one of the largest Bitcoin mining operations in the world and investing in multiple blockchain companies, CNBC still asserts that RIOT drastically overpaid for its mining hardware.

Subpoena Recent News

Last month, Riot Blockchain received a subpoena from the Securities and Exchange Commission “requesting certain information.” After the investigation became public, O’Rourke stated that he couldn’t comment on the situation and that he was unaware of the nature of the investigation or what it is looking into.

Months prior to the subpoena from the SEC, O’ Rourke went on record to CNBC, “I am not worried about the SEC because RIOT over-discloses”.

Quarterly Earnings Report

RIOT released its first-quarter earnings on May 17th. RIOT’s quarterly report revealed that it made less than $1mln dollars in revenue and operated at an overall loss of $1.6mln for the first quarter. Most of the company’s revenue came from its cryptocurrency mining operations which it continued to expand this month.

RIOT’s financial statements also disclosed that it spent $36.4mln over the last six months, leaving the company with only $5.3mln left on its balance sheet. Most of this money has gone into Bitcoin mining hardware and other long-term investments.

With continued investment in Bitcoin mining, we should expect a significant increase in RIOT’s revenue in upcoming quarters.

[thrive_leads id=’5219′]

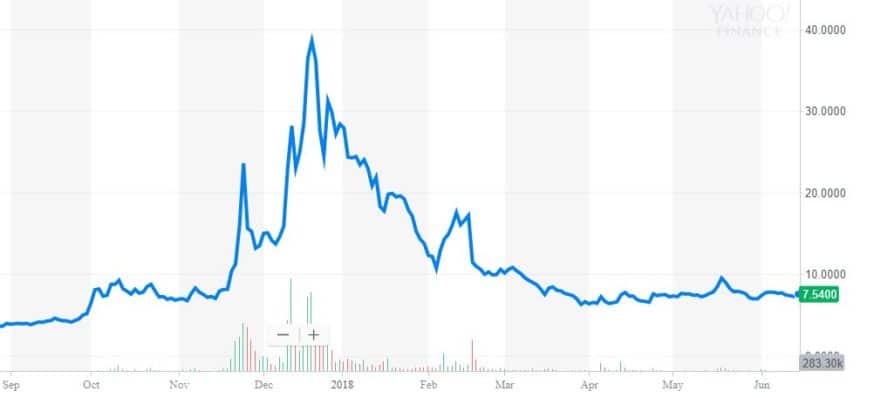

Trading History

When RIOT first rebranded itself as a blockchain focused company back on October 4th, 2017, its stock price immediately jumped 17 percent from $8.18 to $9.50. In just a couple of months, Riot’s stock price rapidly rose to an all-time high of $38.60 on December 19th, 2017.

Since the new year, negative news coverage and the declining cryptocurrency market pushed RIOT’s stock price back to previous price levels before the rebranding announcements. At the time of this writing, Riot’s stock price sits at $7.54.

Final Verdict

Although RIOT isn’t currently operating at a profit, it has acquired a diverse portfolio of blockchain companies and has positioned itself to become a major player in the cryptocurrency industry with its massive investment in mining hardware.

The future financial success of the company will be highly correlated to the performance of the blockchain industry itself, specifically Bitcoin. So, if you believe in Bitcoin, you should probably believe in RIOT as well. Although, both come with their fair share of risks.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.